Review of Corporate Sustainability Due Diligence Directive (CS3D)

- Due diligence

- Sustainability/Due diligence

Summary

This report accompanies the existing AGRINFO report on the Corporate Sustainability Due Diligence Directive.

The Corporate Sustainability Due Diligence Directive 2024/1760 (CS3D) establishes due diligence obligations for large companies, meaning they must identify, prevent, and bring to an end any adverse impacts on human rights and the environment that arise from their operations across the entire value chain.

Most operators outside the European Union (EU) are not directly impacted by these obligations. However, they might be indirectly affected – they may be asked to provide specific information on the impacts their production and processing might have on human rights and the environment to help large companies demonstrate that they meet new due diligence obligations.

In February 2025, the European Commission published a proposal to change certain parts of the Corporate Sustainability Due Diligence Directive 2024/1760 (CS3D) to reduce the regulatory burden and potential negative economic impacts on companies. This is the Directive that establishes due diligence obligations for large companies, meaning they must identify, prevent, and bring to an end any adverse impacts on human rights and the environment that arise from their operations across the entire value chain.

This proposal in principle focuses due diligence on any adverse impacts related to the direct business partners of large companies, and aims to reduce the amount of information requested from indirect business partners. It also recommends that the new requirements apply 1 year later than initially foreseen (from mid-2028). The proposed changes are currently being reviewed and amended by the Council of the EU (Member States) and the European Parliament.

Update: In April 2025, the EU agreed to the 1-year implementation delay proposed by the European Commission (Directive 2025/794). Discussions are ongoing regarding proposed changes to other parts of the CS3D.

EU delays implementation of Corporate Sustainability Due Diligence Directive (CS3D) and considers simplification of certain requirements

Proposal [2025/0045] for a Directive amending Directives 2006/43/EC, 2013/34/EU, (EU) 2022/2464 and (EU) 2024/1760 as regards certain corporate sustainability reporting and due diligence requirements

Directive 2025/794 amending Directives 2022/2464 and 2024/1760 as regards the dates from which Member States are to apply certain corporate sustainability reporting and due diligence requirements

Update

This report accompanies the existing AGRINFO report on the Corporate Sustainability Due Diligence Directive.

The Corporate Sustainability Due Diligence Directive 2024/1760 (CS3D) establishes due diligence obligations for large companies, meaning they must identify, prevent, and bring to an end any adverse impacts on human rights and the environment that arise from their operations across the entire value chain.

Most operators outside the European Union (EU) are not directly impacted by these obligations. However, they might be indirectly affected – they may be asked to provide specific information on the impacts their production and processing might have on human rights and the environment to help large companies demonstrate that they meet new due diligence obligations.

In February 2025, the European Commission published a proposal to change certain parts of the Corporate Sustainability Due Diligence Directive 2024/1760 (CS3D) to reduce the regulatory burden and potential negative economic impacts on companies. This is the Directive that establishes due diligence obligations for large companies, meaning they must identify, prevent, and bring to an end any adverse impacts on human rights and the environment that arise from their operations across the entire value chain.

This proposal in principle focuses due diligence on any adverse impacts related to the direct business partners of large companies, and aims to reduce the amount of information requested from indirect business partners. It also recommends that the new requirements apply 1 year later than initially foreseen (from mid-2028). The proposed changes are currently being reviewed and amended by the Council of the EU (Member States) and the European Parliament.

Update: In April 2025, the EU agreed to the 1-year implementation delay proposed by the European Commission (Directive 2025/794). Discussions are ongoing regarding proposed changes to other parts of the CS3D.

What is changing?

Of the changes proposed, the following are likely to have implications for agri-food suppliers in low-and middle-income countries:

- Large companies operating in the EU that have to comply with the Corporate Sustainability Due Diligence Directive (CS3D) must issue a due diligence statement (assessing their own operations and measures) at least every 5 years (instead of annually).

- Large companies will only need to proactively assess potential adverse impacts in relation to direct business partners rather than all actors in the supply chain. Assessment of indirect partners will only be necessary if specific adverse impacts are identified.

- Where direct partners have fewer than 500 employees, large companies may only request information in a limited number of areas that are set out in a voluntary standard. This standard, which still has to be adopted, will be based on the Voluntary reporting standard for SMEs (VSME) published in 2024 by the European Financial Reporting Advisory Group (EFRAG).

- Large EU companies must operate a due diligence code of conduct. Direct suppliers to these large companies will have to provide contractual assurances that they will comply with this code of conduct. These direct partners will also have to seek contractual assurances from their own suppliers (indirect business partners to the large companies) that the code of conduct is followed. Direct and indirect partners’ compliance with the code of conduct must be verified.

- The new rules will apply first to the largest companies (with more than 3,000 employees and over €900 million net turnover worldwide) from mid-2028, a delay of 1 year.

- General guidelines on how to conduct due diligence in accordance with these rules will be published by 26 July 2026.

For further information on due diligence requirements see Corporate Sustainability Due Diligence Directive.

Why?

This is one of a series of proposals (“Simplification Omnibus Packages”) aimed at stimulating EU growth and competitiveness, while reducing administrative burdens.

The proposed changes are in response to the following concerns.

- Such regulatory burdens could reduce the EU’s competitiveness (Draghi 2024) and indirectly its capacity to meet its Green Deal objectives (European Commission 2025b).

- SMEs have reported concerns about unrealistic and disproportionate demands for information from their business partners (European Commission 2025a).

- Having different obligations for companies under different rules – such as the CS3D and the Corporate Sustainability Reporting Directive (CSRD) – creates additional burdens for companies and may also deter sustainable finance (European Commission 2025a). Aligning legislation helps to reduce the assessment and reporting duties that companies face.

Timeline

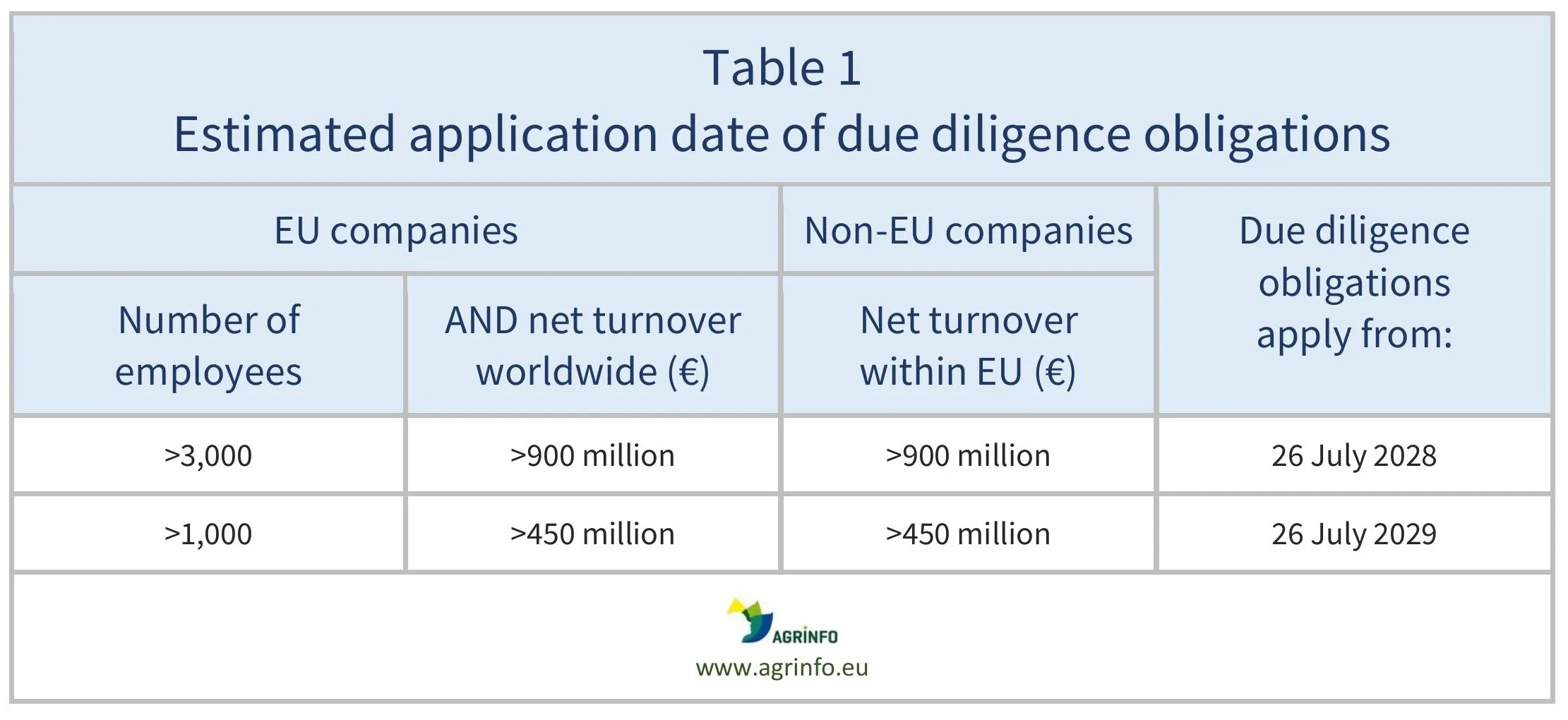

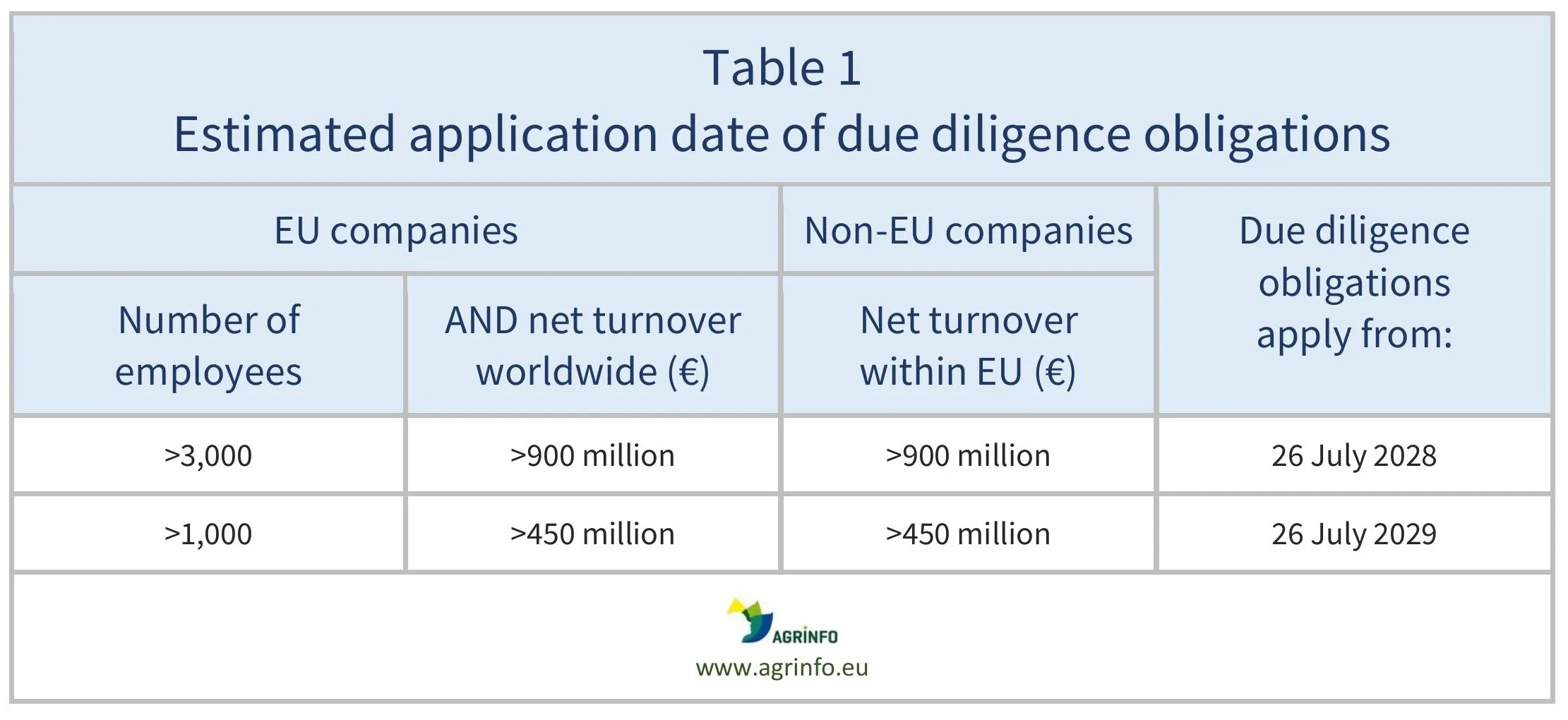

In April 2025, the EU approved the delay in some implementation dates. The due diligence obligations will apply from mid-2028 to mid-2029, depending on the size of the company (see Table 1 for details).

The next step will be for the other proposed changes to be reviewed and amended by the Council of the EU (Member States) and the European Parliament, a process that is expected to be completed in 2026.

What are the major implications for exporting countries?

Under the original CS3D text, large companies operating in the EU were required to engage with all stakeholders (exporters, processors, producers) directly and indirectly involved in their supply chain, including any located outside the EU. The aim was that large companies should demonstrate that they are meeting their due diligence obligations by collecting information along the supply chain.

Under this proposal to amend the CS3D, the requirements would in principle be less stringent, as only producers and processors that are directly supplying large companies would generally be required to collect and provide this information. However, where a company has plausible information suggesting that adverse impacts have arisen or may arise in the operations of an indirect business partner, the large company must carry out an in-depth assessment of the indirect supplier.

At the same time, the latest proposal makes it mandatory for direct suppliers (to large EU companies) to provide contractual assurances that they will comply with the company due diligence code of conduct. They must also obtain contractual assurances from their own business partners that they too are following the code of conduct. Compliance with the code of conduct must be verified. It states in Art 10 (5) that, “for the purposes of verifying compliance, the company may refer to independent third-party verification, including through industry or multi-stakeholder initiatives”. SMEs can request the company that has to comply with the CS3D to cover the costs of the independent third-party verification, either in total, or in part if the SME wishes to share the results of the verification with other companies.

The proposal also aims to limit the amount of information that large EU companies can request from small companies (<500 employees) that directly supply them. This information will be restricted to a number of areas that are listed in a voluntary standard (based on the VSME). However:

- the information required under the VSME is still significant and in certain cases (if there are indications of likely adverse impacts or where the VSME does not cover relevant impacts) further information could be requested.

- the impact of the proposal on indirect suppliers in terms of information demands is still unclear. Large companies will have to operate a due diligence code of conduct; their direct and indirect suppliers will have to provide contractual assurances that they will comply with this, and compliance must be verified. The proposal does not specify what information can be used to demonstrate compliance with the company codes of conduct, or how it will be verified. In particular, is not yet clear of how existing industry third party certification could be used by suppliers to verify compliance.

- It is also not yet clear how the proposed requirement to verify compliance with the company code of conduct will align with the proposal to limit the amount of information from small companies to that specified in the VSME.

Recommended Actions

Smaller operators (<500 employees) directly supplying large companies in the EU can consult the VSME to learn more about the type of information they may need to provide. However, larger companies (>500 employees) may be required to provide additional information.

Background

The Directive is aimed at large companies that must comply directly with due diligence obligations. These are:

- EU companies with more than 1,000 employees and a turnover above €450 million (or the parent company of a group that reaches these thresholds)

- non-EU companies with a net turnover above €450 million within the EU in the financial year before the most recent financial year (or the parent company of a group that reaches these thresholds).

Operators who supply large companies will be indirectly affected, as they will have to provide information and data to help the large companies demonstrate due diligence.

For further information, see Corporate Sustainability Due Diligence Directive.

The CS3D complements the Corporate Sustainability Reporting Directive (CSRD). The CS3D focuses on the actions companies need to take to achieve sustainability, whereas the CSRD focuses on the reporting of those actions.

Resources

Draghi, M. (2024) The future of European competitiveness.

European Commission (2025a) Commission Staff Working Document accompanying the documents […] COM(2025)80 and COM(2025)81

European Commission (2025b) Questions and Answers on Simplification Omnibus I and II

Sources

Proposal [2025/0045] for a Directive as regards certain corporate sustainability reporting and due diligence requirements

Directive (EU) 2025/794 as regards the dates from which Member States are to apply certain corporate sustainability reporting and due diligence requirements

Tables & Figures

Source: Directive 2025/794

Disclaimer: Under no circumstances shall COLEAD be liable for any loss, damage, liability or expense incurred or suffered that is claimed to have resulted from the use of information available on this website or any link to external sites. The use of the website is at the user’s sole risk and responsibility. This information platform was created and maintained with the financial support of the European Union. Its contents do not, however, reflect the views of the European Union.

EU delays implementation of Corporate Sustainability Due Diligence Directive (CS3D) and considers simplification of certain requirements

Proposal [2025/0045] for a Directive as regards certain corporate sustainability reporting and due diligence requirements

Directive 2025/794 as regards the dates from which Member States are to apply certain corporate sustainability reporting and due diligence requirements

What is changing and why?

This report accompanies the existing AGRINFO report on the Corporate Sustainability Due Diligence Directive.

The Corporate Sustainability Due Diligence Directive (CS3D), published in 2024, establishes due diligence obligations for large companies: they must identify, prevent, and bring to an end any adverse impacts on human rights and the environment that arise from their operations across the entire value chain. This can have indirect impacts on operators outside the European Union (EU), requiring them to provide specific information about their operations to help large companies demonstrate that no adverse impacts have occurred in the value chain.

Recognising that these rules could create a burden on companies in the value chain and weaken EU competitiveness, the European Commission proposes the following changes to the CS3D.

- Large companies operating in the EU that have to comply with the CS3D must issue a due diligence statement (assessing their own operations and measures) at least every 5 years (instead of every year).

- Large companies will only need to assess adverse impacts in relation to direct business partners, rather than all actors in the supply chain. Assessment of indirect partners will only be necessary if specific adverse impacts are identified.

- Where direct partners are companies with fewer than 500 employees, large companies may only request information in a limited number of areas that will be set out in a voluntary standard (still to be adopted).

- Direct suppliers to large companies will have to provide contractual assurances that they will comply with the buyer’s code of conduct on due diligence, and must seek the same contractual assurances from their own business partners (indirect business partners to the large companies). Direct and indirect partners’ compliance with the code of conduct must be verified, potentially through third-party verification including industry or multi-stakeholder initiatives.

- The new rules will first apply for the largest companies from mid-2028, a delay of 1 year.

- Guidelines on how to conduct due diligence in accordance with these rules will be published by 26 July 2026, 6 months earlier than foreseen in the Directive.

In April 2025, the EU agreed to the 1-year implementation delay proposed by the European Commission (Directive 2025/794). Discussions are continuing on the proposal to change other parts of the CS3D.

Actions

Smaller operators (<500 employees) directly supplying large companies in the EU can consult the Voluntary reporting standard for SMEs (VSME) to learn more about the type of information they may need to provide. However, larger companies (>500 employees) may be required to provide additional information.

Timeline

In April 2025, the EU approved the delay in some implementation dates. The due diligence obligations will apply from mid-2028 to mid-2029, depending on the size of the company (see Table 1 for details).

The next step will be for the other proposed changes to be reviewed and amended by the Council of the EU (Member States) and the European Parliament, a process that may take 2–3 years.

Tables & Figures

Source: Directive 2025/794

Disclaimer: Under no circumstances shall COLEAD be liable for any loss, damage, liability or expense incurred or suffered that is claimed to have resulted from the use of information available on this website or any link to external sites. The use of the website is at the user’s sole risk and responsibility. This information platform was created and maintained with the financial support of the European Union. Its contents do not, however, reflect the views of the European Union.