Proposal introducing tariffs for e-commerce

- Tariffs & quotas

- Trade

Summary

E-commerce goods imported into the EU that are valued at less than €150 currently do not pay import tariffs. The European Commission proposes to to remove the tariff exemption on low-value e-commerce goods, and to introduce simplified tariffs for all e-commerce goods.

EU to remove zero tariff exemption on low-value e-commerce goods, and to introduce simplified tariffs. EU consultation

Proposal for a Council Regulation amending Regulation (EEC) No 2658/87 as regards the introduction of a simplified tariff treatment for the distance sales of goods and Regulation (EC) No 1186/2009 as regards the elimination of the customs duty relief threshold

Update

E-commerce goods imported into the EU that are valued at less than €150 currently do not pay import tariffs. The European Commission proposes to to remove the tariff exemption on low-value e-commerce goods, and to introduce simplified tariffs for all e-commerce goods.

What is changing?

This Regulation concerns E-commerce sales of goods, including agrifood products, that are sold directly from a non-EU country to businesses, households, individuals or private organizations, through electronic transactions conducted via the internet. Today, EU customers do not currently pay import tariffs on these goods provided their value is less than €150.

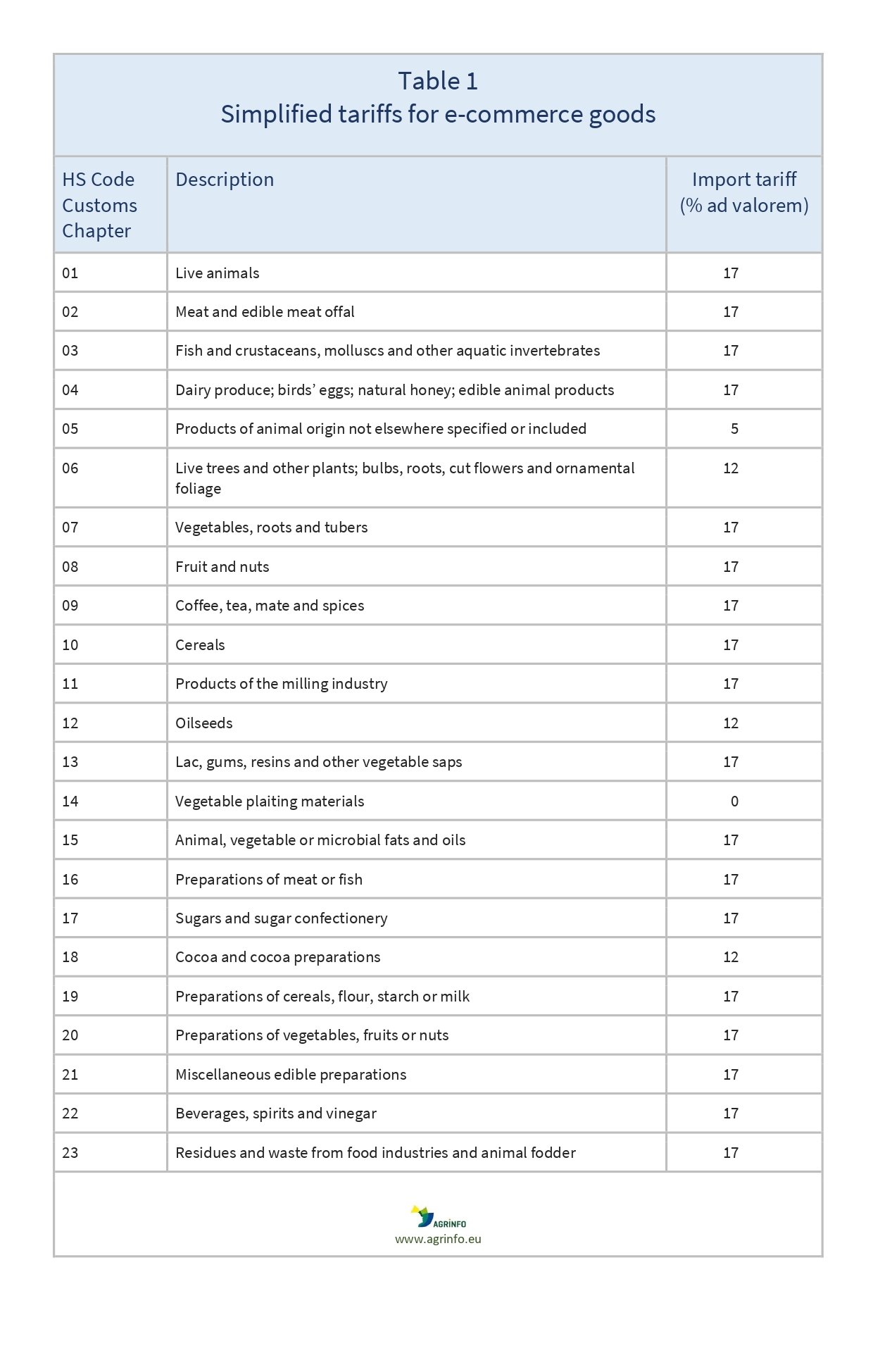

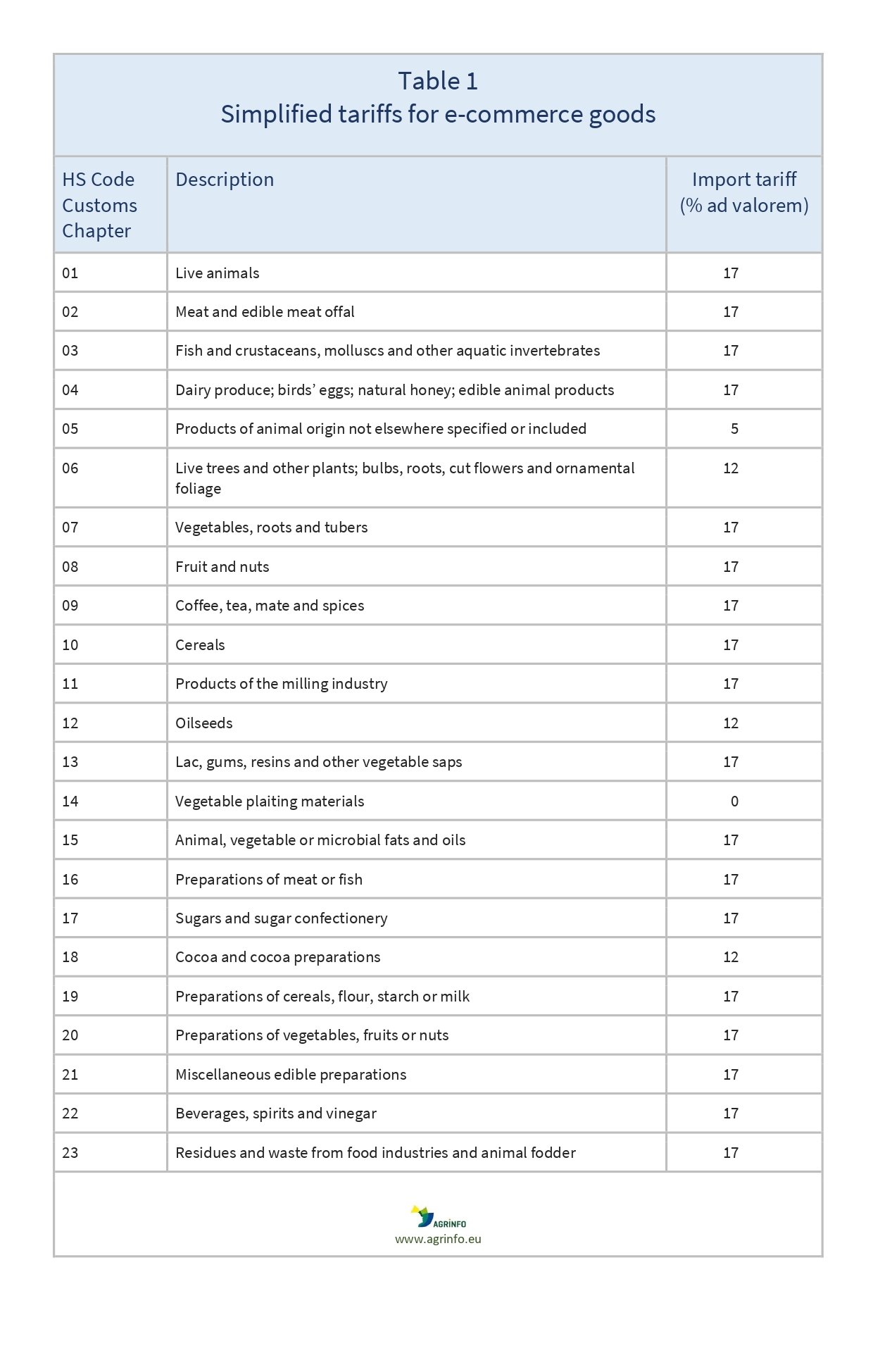

The Commission now proposes to remove this exception for low-value e-commerce goods so that import tariffs will have to be paid on all e-commerce goods. It also proposes to put in place a simplified system of tariffs for all e-commerce goods, which may be applied at the request of the importer. The e-commerce tariffs for agri-food products are set out in Table 1.

Importers can choose to use conventional rather than simplified tariffs. Importers of e-commerce goods from non-EU countries currently paying zero or reduced tariffs (under the General System of Preferences) can continue to benefit from these preferential tariffs by proving the origin of goods in the standard way.

Where the EU has put in place specific tariffs to restrict imports (safeguard tariffs, anti-dumping or anti-subsidy duties), these will continue to apply to all goods including e-commerce goods.

Why?

The current exemption from import tariffs on e-commerce goods valued at less than €150 is difficult for customs authorities to check. E-commerce consignments are reported to be regularly undervalued to avoid paying import duties. This favours e-commerce in non-EU countries over traditional trade by EU retailers importing in bulk.

The standard method of calculating tariffs is based on the tariff classification, the customs value and the origin of goods. For e-commerce goods, particularly single products, it poses a disproportionate burden for customs authorities and EU businesses, so simplified tariffs are needed.

Timeline

Feedback on the proposal can be provided via the Commission webpage Revision of the Union Customs Code until 20 July 2023.

The new rules will apply from 1 March 2028.

What are the major implications for exporting countries?

For non-EU exporting countries that benefit from zero or preferential import tariffs, removing the import tariff exemption for e-commerce goods under the value of €150 may not have a significant impact. These preferential tariffs still apply in the same way as for non-e-commerce goods, using standard procedures identifying the country of origin.

Suppliers of low-value e-commerce goods in other non-EU countries may face higher import tariffs.

Recommended Actions

Feedback on the proposal can be provided via the Commission webpage Revision of the Union Customs Code until 20 July 2023. This feedback will be presented to the Council of the EU to inform the legislative debate.

Background

This is one of three proposals aiming to modernise the EU’s customs system and respond to increasing trade volumes (in particular for e-commerce). The other two proposals are to simplify VAT on e-commerce and to establish a Union Customs Code and Customs Authority.

Resources

European Commission (2023) Customs Reform: Taking the Customs Union to the Next Level.

Sources

Proposal for a Regulation on the introduction of a simplified tariff treatment for the distance sales of goods and elimination of the customs duty relief threshold

Tables & Figures

Source: Proposal for a Regulation on the introduction of a simplified tariff treatment

Disclaimer: Under no circumstances shall COLEAD be liable for any loss, damage, liability or expense incurred or suffered that is claimed to have resulted from the use of information available on this website or any link to external sites. The use of the website is at the user’s sole risk and responsibility. This information platform was created and maintained with the financial support of the European Union. Its contents do not, however, reflect the views of the European Union.

EU to remove zero tariff exemption on low-value e-commerce goods, and to introduce simplified tariffs. EU consultation

Proposal for a Council Regulation amending Regulation 2658/87

What is changing and why?

E-commerce goods imported into the EU that are valued at less than €150 currently do not pay import tariffs. This rule is difficult for customs authorities to check, and many traders have been reported as undervaluing consignments to avoid paying import duties.The European Commission proposes to remove the tariff exemption on low-value e-commerce goods, and to introduce simplified tariffs for all e-commerce goods.

Actions

Feedback on the proposal can be provided via the Commission website Revision of the Union Customs Code until 20 July 2023.

Timeline

The new rules will apply from 1 March 2028.

Tables & Figures

Source: Proposal for a Regulation on the introduction of a simplified tariff treatment

Disclaimer: Under no circumstances shall COLEAD be liable for any loss, damage, liability or expense incurred or suffered that is claimed to have resulted from the use of information available on this website or any link to external sites. The use of the website is at the user’s sole risk and responsibility. This information platform was created and maintained with the financial support of the European Union. Its contents do not, however, reflect the views of the European Union.